Health insurance payroll deduction calculator

You can enter your current payroll. Health Insurance POP etc.

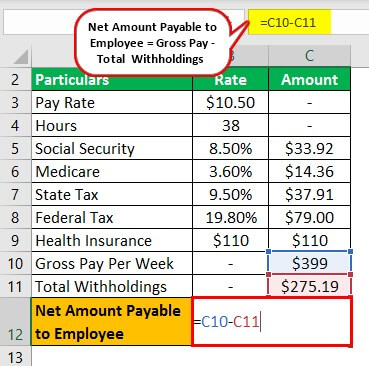

Payroll Formula Step By Step Calculation With Examples

The maximum an employee will pay in 2022 is 911400.

. The annual cost is divided by the number of. Contributions to health vision and dental insurance. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Your income puts you in the 25 tax bracket. Thats where our paycheck calculator comes in. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Report it on form P11D. You can enter your current payroll information and deductions and. In these situations the employer pays the insurance company the full premium amount and then the employer is reimbursed by the employee via pre-tax payroll.

Ad Compare This Years Top 5 Free Payroll Software. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. During the tax year the employer works out the taxable amount of the benefit and adds this to the employees actual monthly pay.

Ad Payroll So Easy You Can Set It Up Run It Yourself. While shopping for health benefits. Your employee arranges treatment or insurance but you pay the provider.

Simplify Your Employee Reimbursement Processes. But thats not always the case. 1547 would also be your average tax rate.

Select on the employee and go to section 5 click Add deduction link. Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. 2022 Federal income tax withholding calculation.

Select these options from the drop-down. Zenefits calculates and pushes. Ad Help Your Employees Manage Their Health Expenses With The Fidelity HSA.

All Services Backed by Tax Guarantee. This is 1547 of your total income of 72000. Subtract 12900 for Married otherwise.

It can also be used to help fill steps 3 and 4 of a W-4 form. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Employees paid bi-weekly 26 pay dates a year usually have two pay dates a month but will have three pay dates in some months.

Subtract 12900 for Married otherwise. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business. Go to the employees profile.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Your taxes are estimated at 11139.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Assume that the cost of a companys health insurance plan is 300 per biweekly pay period and that the employee is responsible for paying 25 of the cost through payroll withholding. An employees contribution to certain health plans may qualify as pretax deductions.

Add the value of the benefit to the employees earnings when deducting and paying. Use this calculator to help you determine the impact of changing your payroll deductions. You can enter your current payroll information and.

All Services Backed by Tax Guarantee. 2022 Federal income tax withholding calculation. This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation.

Learn More About Our Payroll Options. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Free Unbiased Reviews Top Picks.

Voted Top 2021 HSA By Investors Business Daily For Investment Quality Options Fees.

Are Payroll Deductions For Health Insurance Pre Tax Details More

Salary Formula Calculate Salary Calculator Excel Template

Are Payroll Deductions For Health Insurance Pre Tax Details More

Paycheck Calculator Take Home Pay Calculator

Salary Formula Calculate Salary Calculator Excel Template

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Do Payroll In Excel In 7 Steps Free Template

Understanding Payroll Taxes And Who Pays Them Smartasset

How To Do Payroll In Excel In 7 Steps Free Template

What Are Marriage Penalties And Bonuses Tax Policy Center

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Salary Paycheck Calculator Sale 54 Off Www Wtashows Com

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Net Pay Step By Step Example

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples